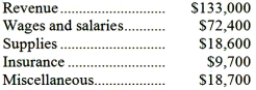

Schoeppner Corporation uses customers served as its measure of activity. During October, the company budgeted for 39,000 customers, but actually served 42,000 customers. The company bases its budgets on the following information: Revenue should be $3.10 per customer served. Wages and salaries should be $38,100 per month plus $0.80 per customer served. Supplies should be $0.40 per customer served. Insurance should be $9,600 per month. Miscellaneous expenses should be $3,400 per month plus $0.40 per customer served. The company reported the following actual results for October:  Required:

Required:

Prepare the company's flexible budget performance report for October. Label each variance as favorable (F) or unfavorable (U).

Definitions:

Creditor's Decision

The process through which a creditor analyzes the financial stability and creditworthiness of potential borrowers before lending money.

Short-term Obligations

Financial liabilities or debts that are due to be paid within a year.

Utilities Expense

Costs incurred by a business for basic utilities, such as electricity, water, and gas, necessary for operations.

Adjusting Entry

An accounting journal entry made at the end of an accounting period to update the accounts for accruals and deferrals that have not been recorded during the period.

Q8: If the company plans to sell 670,000

Q16: Directly comparing static budget costs to actual

Q27: The net present value of this investment

Q55: How much overhead was applied to products

Q70: The personnel expenses in the planning budget

Q108: In addition to the facts given above,

Q135: Borden Enterprises uses standard costing. For the

Q143: The variable overhead rate variance for supplies

Q163: The Reedy Company uses a standard costing

Q178: Thompson Company uses a standard cost system