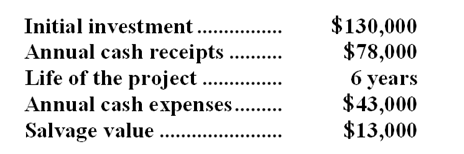

Morgado Inc. has provided the following data to be used in evaluating a proposed investment project:  The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 5 years without any reduction for salvage value. The company uses a discount rate of 19%.

The company's tax rate is 30%. For tax purposes, the entire initial investment will be depreciated over 5 years without any reduction for salvage value. The company uses a discount rate of 19%.

-When computing the net present value of the project,what are the annual after-tax cash receipts?

Definitions:

Economic Profits

The surplus remaining after deducting all costs, including opportunity costs, from total revenues, indicating the financial performance exceeding the break-even point.

Implicit Costs

The opportunity costs that arise from using resources owned by the firm for its own production instead of earning revenue from these resources elsewhere.

Normal Profit

The lowest amount of profit a company must earn to stay competitive and cover its opportunity costs.

Implicit Costs

Implicit costs, also known as imputed or opportunity costs, are the costs of resources owned by the firm that are used in its own production process.

Q13: What is the lowest selling price per

Q15: (Ignore income taxes in this problem.) The

Q45: Narayan Corporation has an activity-based costing system

Q47: Foulds Company makes 10,000 units per year

Q61: Vitko Corporation makes automotive engines. For the

Q62: Which of the following comparisons best isolates

Q67: Suppose that regular sales of jigs total

Q122: In activity-based costing, some manufacturing costs may

Q172: The standard material allowed to produce one

Q254: Carnes Tech is a for-profit vocational school.