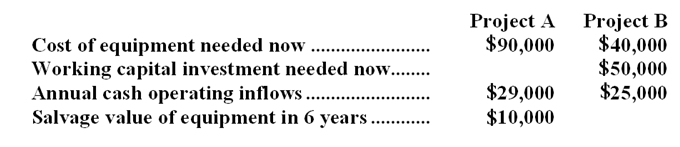

(Ignore income taxes in this problem.) Rushforth Manufacturing has $90,000 to invest in either Project A or Project B. The following data are available on these projects:  Both projects will have a useful life of 6 years. At the end of 6 years, the working capital investment will be released for use elsewhere. Rushforth's required rate of return is 14%.

Both projects will have a useful life of 6 years. At the end of 6 years, the working capital investment will be released for use elsewhere. Rushforth's required rate of return is 14%.

-The net present value of Project A is:

Definitions:

Per Unit

A term that refers to expressing costs, revenues, or any other financial metric on a per unit of production or per unit of sale basis.

Fixed Manufacturing Overhead

These are production costs that do not change with the level of manufacturing activity, such as rent for factory premises.

Inventories

Assets held for sale in the ordinary course of business, or materials to be used or consumed in the production process.

Deferred

Postponed or delayed actions or transactions, often referring to income or expenses that will be recognized in a future accounting period.

Q9: What is the product margin for Product

Q15: If by dropping a product a firm

Q15: The net present value of the project

Q26: Findt & Thompson PLC, a consulting firm,

Q65: (Ignore income taxes in this problem) The

Q91: Crovo Corporation uses customers served as its

Q95: (Ignore income taxes in this problem.) Limon

Q135: Spring Company has invested $20,000 in a

Q146: The unit product cost under variable costing

Q243: The wages and salaries in the planning