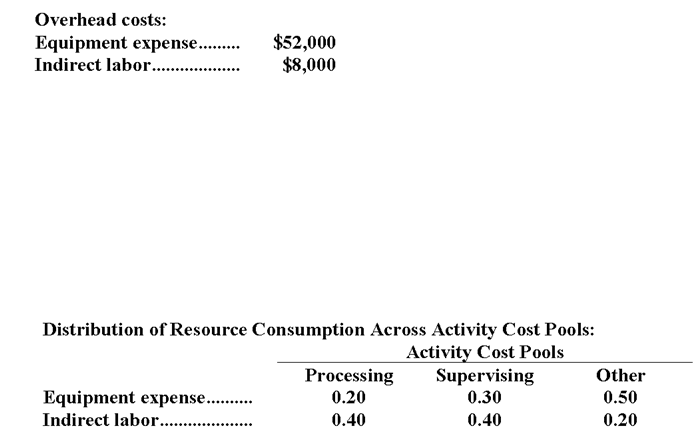

Roshannon Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts-equipment expense and indirect labor-to three activity cost pools-Processing, Supervising, and Other-based on resource consumption. Data to perform these allocations appear below:  In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

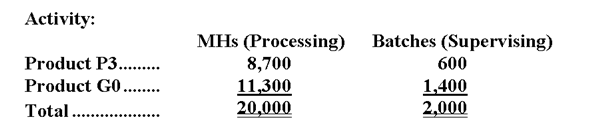

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:  Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

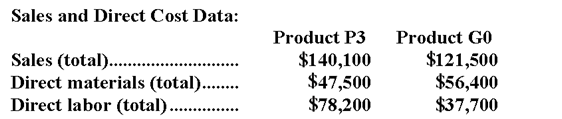

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

-What is the product margin for Product P3 under activity-based costing?

Definitions:

Interest-Burden Ratio

A financial metric that measures the proportion of a company's earnings before taxes that is consumed by interest expenses.

Profit Margin

A financial metric used to evaluate a company's financial health by revealing the percentage of revenue that exceeds the costs of goods sold.

Compound Leverage Factor

A measure used in finance to quantify the effects of leveraging, or the use of borrowed funds, on the compound rate of return for an investment, highlighting both the potential gains and risks.

Channel Stuffing

This is a deceptive business practice used by a company to inflate its sales figures by forcibly pushing more products into the distribution channel than it can sell to the end customers.

Q3: The cost of December merchandise purchases would

Q7: Assume that there is no other use

Q9: When computing the net present value of

Q27: A manufacturing company that produces a single

Q78: The unadjusted cost of goods sold (in

Q94: What is the overhead cost assigned to

Q104: In capital budgeting, what will be the

Q117: How much overhead cost is allocated to

Q169: The contribution margin ratio is 30% for

Q169: Moore Company produces a single product. During