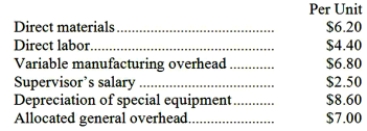

Fillip Corporation makes 4,000 units of part U13 each year. This part is used in one of the company's products. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to make and sell the part to the company for $21.60 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $3,000 of these allocated general overhead costs would be avoided. In addition, the space used to produce part U13 would be used to make more of one of the company's other products, generating an additional segment margin of $13,000 per year for that product. What would be the impact on the company's overall net operating income of buying part U13 from the outside supplier?

An outside supplier has offered to make and sell the part to the company for $21.60 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $3,000 of these allocated general overhead costs would be avoided. In addition, the space used to produce part U13 would be used to make more of one of the company's other products, generating an additional segment margin of $13,000 per year for that product. What would be the impact on the company's overall net operating income of buying part U13 from the outside supplier?

Definitions:

Greco-Roman Figure

An artistic representation that draws on the ideals and styles of ancient Greek and Roman art, typically emphasizing the human body's beauty and proportion.

Hercules

Hercules, in classical mythology, is a Roman hero and god famed for his incredible strength and for completing twelve difficult labors as penance for his actions.

Christian Church

A religious institution centered on the teachings of Jesus Christ and the Bible, spanning various denominations worldwide, with significant influence on culture, politics, and society.

Vestibule Area

An entrance or a lobby area outside the main part of a building, serving as an antechamber or a waiting area.

Q7: Gore Corporation has two divisions: the Business

Q9: If the company bases its predetermined overhead

Q22: Dull Corporation has been producing and selling

Q35: (Ignore income taxes in this problem.) Gocke

Q38: What is the overhead cost assigned to

Q41: Part E43 is used in one of

Q53: The net operating income in the planning

Q55: (Ignore income taxes in this problem.) An

Q77: Ignoring any salvage value, to the nearest

Q243: The wages and salaries in the planning