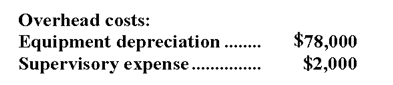

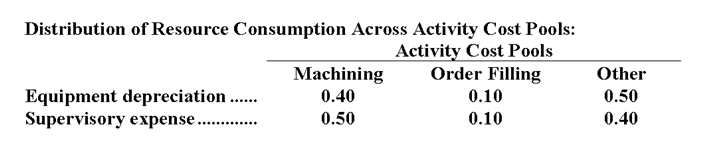

Capizzi Corporation has an activity-based costing system with three activity cost pools-Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to three activity cost pools based on resource consumption. Data used in the first stage allocations follow:

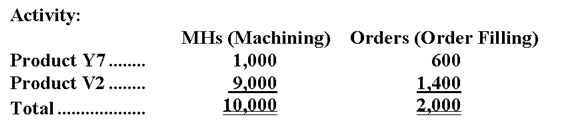

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

-What is the overhead cost assigned to Product V2 under activity-based costing?

Definitions:

Compounded Nominal

Refers to the nominal interest rate which is compounded at certain intervals over a specified period but not necessarily reflecting the actual annual rate of return.

Annuity

An annuity is a financial instrument that provides a consistent series of payments to a person, often serving as a source of income for those who have retired.

Annuitant

The individual entitled to receive payments from an annuity contract, usually during retirement.

Annually Compounded

A compound interest calculation where the interest is added to the principal at the end of each year.

Q8: Lagasca Corporation's contribution format income statement for

Q52: Pitkin Company produces a part used in

Q69: Customer-level activities relate to specific customers and

Q72: How much overhead cost is allocated to

Q106: In responsibility accounting, each segment in an

Q110: A company with a degree of operating

Q130: Puchalla Corporation sells a product for $230

Q133: Mccaskey Corporation uses an activity-based costing system

Q219: A company has provided the following data:

Q235: Sensabaugh Inc., a company that produces and