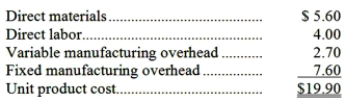

A customer has requested that Inga Corporation fill a special order for 2,000 units of product K81 for $25.00 a unit. While the product would be modified slightly for the special order, product K81's normal unit product cost is $19.90:  Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product K81 that would increase the variable costs by $1.20 per unit and that would require an investment of $10,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. If the special order is accepted, the company's overall net operating income would increase (decrease) by:

Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product K81 that would increase the variable costs by $1.20 per unit and that would require an investment of $10,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. If the special order is accepted, the company's overall net operating income would increase (decrease) by:

Definitions:

Sales Price

The amount of money charged for a product or service in the market.

Current Profits

The amount of net income that a company has generated during the current fiscal period, reflecting its financial performance in the short term.

Production

The process of creating, manufacturing, or assembling goods and services.

Absorption Costing

A method of inventory costing that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed manufacturing overhead - in the cost of a product.

Q9: The cost of goods manufactured equals beginning

Q10: Hugle Corporation's activity-based costing system has three

Q10: The Carlquist Company makes and sells a

Q14: Transaction drivers usually take more effort to

Q24: Costs which are always relevant in decision

Q43: The internal rate of return for a

Q52: Accounts payable at the end of December

Q60: What is the overhead cost assigned to

Q79: The budgeted cash disbursements for December are:<br>A)$435,000<br>B)$385,000<br>C)$425,000<br>D)$465,000

Q107: Wright Company produces products I, J, and