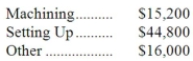

Hugle Corporation's activity-based costing system has three activity cost pools-Machining, Setting Up, and Other. The company's overhead costs have already been allocated to these cost pools as follows:  Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

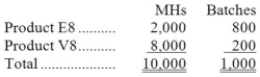

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:  Additional data concerning the company's products appears below:

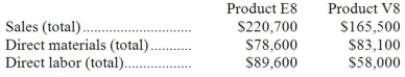

Additional data concerning the company's products appears below:  Required:

Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.

b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

c. Determine the product margins for each product using activity-based costing.

Definitions:

Q1: Only those costs that would disappear over

Q24: The management of Trew Corporation would like

Q37: Suppose the price for the subcomponent has

Q42: (Ignore income taxes in this problem.) Bill

Q43: The following data have been recorded for

Q47: (Ignore income taxes in this problem.) The

Q53: Generally, a product line should be dropped

Q72: A shift in the sales mix from

Q97: Pacey Inc. uses a job-order costing system

Q212: Zumpano Inc. produces and sells a single