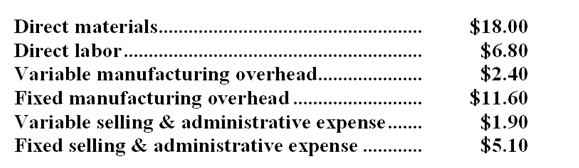

Elhard Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 40,000 units per month is as follows: The normal selling price of the product is $51.10 per unit.

The normal selling price of the product is $51.10 per unit.

An order has been received from an overseas customer for 2,000 units to be delivered this month at a special discounted price. This order would have no effect on the company's normal sales and would not change the total amount of the company's fixed costs. The variable selling and administrative expense would be $0.10 less per unit on this order than on normal sales.

Direct labor is a variable cost in this company.

-Suppose there is ample idle capacity to produce the units required by the overseas customer and the special discounted price on the special order is $41.60 per unit.By how much would this special order increase (decrease) the company's net operating income for the month?

Definitions:

Divisional

A divisional structure in an organization is a form of internal organization where divisions are created to operate semi-autonomously, each focusing on a particular product line, market sector, or geographical area.

Organizational Structure

The system of tasks, workflows, reporting relationships, and communication channels that link together the work of diverse individuals and groups.

Functional Authority

Functional authority is the right granted to individuals based on their expertise in specific areas, allowing them to direct activities within their domain of expertise.

Advisory Authority

The power to give advice and recommendations without having the authority to mandate actions.

Q2: Which of the following statements concerning ease

Q9: The present value of a given amount

Q12: A company anticipates a depreciation deduction of

Q48: What is the product margin for Product

Q55: (Ignore income taxes in this problem.) An

Q66: The activity rate for the Machining activity

Q73: A duration driver is:<br>A)A simple count of

Q99: If the budgeted direct labor time for

Q110: (Ignore income taxes in this problem.) The

Q191: Selling and administrative expenses are considered to