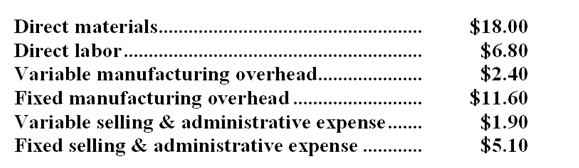

Elhard Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 40,000 units per month is as follows: The normal selling price of the product is $51.10 per unit.

The normal selling price of the product is $51.10 per unit.

An order has been received from an overseas customer for 2,000 units to be delivered this month at a special discounted price. This order would have no effect on the company's normal sales and would not change the total amount of the company's fixed costs. The variable selling and administrative expense would be $0.10 less per unit on this order than on normal sales.

Direct labor is a variable cost in this company.

-Suppose the company is already operating at capacity when the special order is received from the overseas customer.What would be the opportunity cost of each unit delivered to the overseas customer?

Definitions:

Average Tax Rate

The ratio of total taxes paid to total income, representing the overall percentage of income that is taken by taxes.

Marginal Tax Rate

The rate at which the last dollar of a taxpayer's income is taxed, indicating how much of any additional income will be taken in taxes.

Marginal Tax Rate

The percentage of tax applied to the last dollar earned, reflecting the rate at which each additional dollar of income is taxed.

Additional Income

Earnings received beyond the regular pay or salary, such as bonuses or overtime pay.

Q13: What is the lowest selling price per

Q30: Clines Corporation bases its budgets on machine-hours.

Q33: Coakley Beet Processors, Inc., processes sugar beets

Q42: How much profit (loss) does the company

Q58: In general, duration drivers are more accurate

Q67: Property taxes are an example of a

Q89: The total cost of Jurislon to be

Q95: Under variable costing, the unit product cost

Q109: The payback period for the investment would

Q137: (Ignore income taxes in this problem.) Tranter,