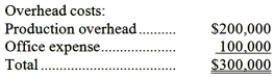

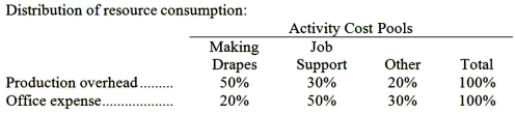

Inskeep Draperies makes custom draperies for homes and businesses. The company uses an activity-based costing system for its overhead costs. The company has provided the following data concerning its annual overhead costs and its activity cost pools.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

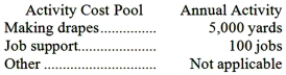

The amount of activity for the year is as follows:  Required:

Required:

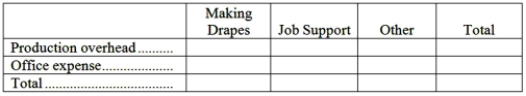

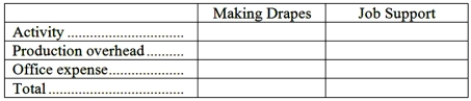

a. Prepare the first-stage allocation of overhead costs to the activity cost pools by filling in the table below:  b. Compute the activity rates (i.e., cost per unit of activity) for the Making Drapes and Job Support activity cost pools by filling in the table below:

b. Compute the activity rates (i.e., cost per unit of activity) for the Making Drapes and Job Support activity cost pools by filling in the table below:  c. Prepare an action analysis report in good form of a job that involves making 70 yards of drapes and has direct materials and direct labor cost of $1,870. The sales revenue from this job is $3,700.

c. Prepare an action analysis report in good form of a job that involves making 70 yards of drapes and has direct materials and direct labor cost of $1,870. The sales revenue from this job is $3,700.

For purposes of this action analysis report, direct materials and direct labor should be classified as a Green cost; production overhead as a Red cost; and office expense as a Yellow cost.

Definitions:

Q3: (Ignore income taxes in this problem.) You

Q14: Data for May concerning Dorow Corporation's two

Q29: Rank the projects according to the profitability

Q56: Segmented statements for internal use should be

Q86: The unadjusted cost of goods sold (in

Q119: UHF Antennas, Inc., produces and sells a

Q126: Redner, Inc. produces three products. Data concerning

Q137: (Ignore income taxes in this problem.) Tranter,

Q143: The net present value of the proposed

Q147: Two products, IF and RI, emerge from