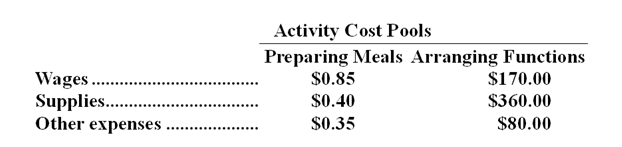

Groenen Catering uses activity-based costing for its overhead costs. The company has provided the following data concerning the activity rates in its activity-based costing system:  The number of meals served is the measure of activity for the Preparing Meals activity cost pool. The number of functions catered is used as the activity measure for the Arranging Functions activity cost pool.

The number of meals served is the measure of activity for the Preparing Meals activity cost pool. The number of functions catered is used as the activity measure for the Arranging Functions activity cost pool.

Management would like to know whether the company made any money on a recent function at which 120 meals were served. The company catered the function for a fixed price of $20.00 per meal. The cost of the raw ingredients for the meals was $13.05 per meal. This cost is in addition to the costs of wages, supplies, and other expenses detailed above.

For the purposes of preparing action analyses, management has assigned ease of adjustment codes to the costs as follows: wages are classified as a Yellow cost; supplies and raw ingredients as a Green cost; and other expenses as a Red cost.

-Suppose an action analysis report is prepared for the function mentioned above.What would be the "yellow margin" in the action analysis report? (Round to the nearest whole dollar. )

Definitions:

Quantitative Model

Analytical and numeric approaches used in decision-making processes to solve human resource management problems.

Qualitative Model

A model that uses non-numerical data to analyze phenomena and provides insights based on qualities rather than quantities.

Demand Forecast

The process of estimating the future demand for a product or service based on historical data and analysis.

Perceived Status Differences

The assumption or belief regarding the ranking or importance of individuals or groups relative to others.

Q2: What would be the effect on the

Q5: Reynold Enterprises sells a single product for

Q7: Suppose an action analysis report is prepared

Q12: All other things equal, if a division's

Q51: The activity rate for the Supervising activity

Q67: What is the net operating income for

Q81: The difference between cash receipts and cash

Q97: (Ignore income taxes in this problem.) Farah

Q135: Leigh Company, which has only one product,

Q143: The net present value of the proposed