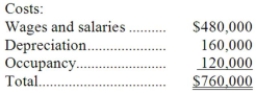

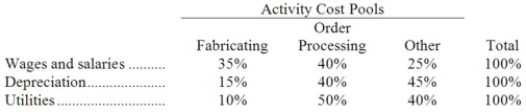

Higbie Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs:  The distribution of resource consumption across the three activity cost pools is given below:

The distribution of resource consumption across the three activity cost pools is given below:  How much cost, in total, would be allocated in the first-stage allocation to the Fabricating activity cost pool?

How much cost, in total, would be allocated in the first-stage allocation to the Fabricating activity cost pool?

Definitions:

Slope Coefficient

A measure that indicates the rate at which a dependent variable changes in relation to an independent variable, often used in linear regression analysis.

CAPM

Capital Asset Pricing Model, a theory that delineates the correlation between expected return on investments and the inherent systematic risk, especially in the context of equities.

Security Characteristic Line

Represents a regression line that displays the relationship between a security's returns and the market's returns, used to assess risk and performance.

Security Market Line

A representation of the capital asset pricing model (CAPM) which displays the expected return of a security as a function of its systematic, or non-diversifiable, risk.

Q25: In an income statement segmented by product

Q25: What would the annual net cash inflows

Q66: The carrying value of finished goods inventory

Q73: The salary paid to a store manager

Q80: If sales in Store Q increase by

Q89: Kempler Corporation processes sugar cane in batches.

Q89: Daba Company manufactures two products, Product F

Q111: (Ignore income taxes in this problem.) Juliar

Q115: If new equipment is replacing old equipment,

Q135: Maccarone Corporation has provided the following data