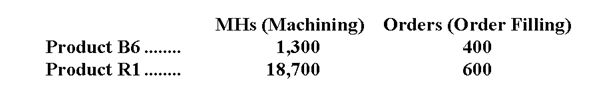

Ormond Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Machining, $6,800; Order Filling, $10,700; and Other, $4,500. Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

-What is the overhead cost assigned to Product B6 under activity-based costing?

Definitions:

Ability-To-Pay Principle

The idea that those who have greater income (or wealth) should pay a greater proportion of it as taxes than those who have less income (or wealth).

Marginal Cost

the additional cost incurred to produce one more unit of a good or service.

Marginal Benefit

The added joy or utility one achieves by consuming an additional unit of a product or service.

Cost-Benefit Analysis

is a systematic approach to estimating the strengths and weaknesses of alternatives, used to determine the best option through weighing the cost against benefits.

Q28: A manufacturing company that produces a single

Q31: Data concerning Lancaster Corporation's single product appear

Q36: Under variable costing,all variable costs are treated

Q37: What is the unit product cost for

Q63: If the company sells 7,300 units,its net

Q70: Capati Corporation is working on its direct

Q97: Zumpano Inc.produces and sells a single product.The

Q122: A manufacturing company that produces a single

Q142: This question is to be considered independently

Q180: The management of Paye Corporation expects sales