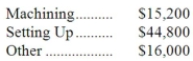

Hugle Corporation's activity-based costing system has three activity cost pools-Machining, Setting Up, and Other. The company's overhead costs have already been allocated to these cost pools as follows:  Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

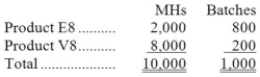

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:  Additional data concerning the company's products appears below:

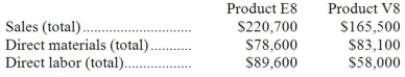

Additional data concerning the company's products appears below:  Required:

Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.

b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

c. Determine the product margins for each product using activity-based costing.

Definitions:

Cash Bonuses

Monetary rewards given to employees as incentives for achieving specific performance goals or milestones.

Senior Executive Ranks

The highest levels of management within an organization, typically responsible for strategic planning and decision-making.

Lower Ranks

Positions at the bottom or near the bottom of an organizational or hierarchical structure, often with fewer responsibilities and authority.

Non-Exempt Levels

Employment positions not covered by the Fair Labor Standards Act's overtime provisions, typically paid hourly.

Q2: What would be the effect on the

Q13: If the company bases its predetermined overhead

Q19: When computing the net present value of

Q22: A company anticipates a taxable cash expense

Q48: Knoke Corporation's contribution margin ratio is 29%

Q57: (Ignore income taxes in this problem.) Charley

Q89: Kempler Corporation processes sugar cane in batches.

Q132: Rank the products in order of their

Q135: Leigh Company, which has only one product,

Q137: If Lemine produces and sells only 6,000