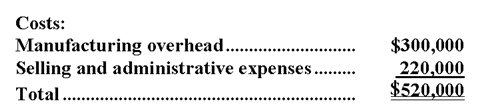

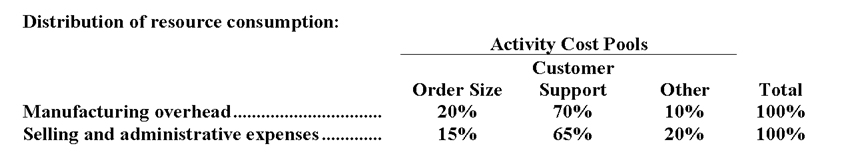

Dillner Company uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity based costing system:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

You have been asked to complete the first-stage allocation of costs to the activity cost pools.

-How much cost,in total,would be allocated in the first-stage allocation to the Order Size activity cost pool?

Definitions:

Taxable Entity

An individual, organization, or entity that is subject to taxation by government authorities based on income, property, sales, or other tax determinations.

Fourteenth Amendment

An amendment to the US Constitution that grants citizenship to everyone born or naturalized in the USA and guarantees all citizens equal protection under the law.

Due Process Rights

Due process rights are legal guarantees ensuring fair treatment through the judicial system, including the right to a fair trial and the right to be heard.

Corporate Shareholders

Individuals or entities that own shares in a corporation, giving them rights to dividends and a say in company matters.

Q2: The management of Svatek Corporation would like

Q3: The applied manufacturing overhead for the year

Q7: Gore Corporation has two divisions: the Business

Q11: Organization-sustaining activities are activities of the general

Q26: The applied manufacturing overhead for the year

Q36: Expected cash collections in December are:<br>A)$59,400<br>B)$140,000<br>C)$199,400<br>D)$200,000

Q44: Cost of goods sold equals beginning finished

Q71: Assuming that the company charges $613.98 for

Q86: The activity rate for the Supervising activity

Q112: Nutall Corporation is considering dropping product N28X.