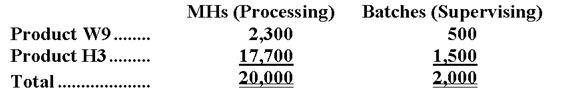

Sibble Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $12,400; Supervising, $4,400; and Other, $5,200. Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

-The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

Definitions:

Per Month

The term per month is used to describe or quantify an event, action, or measurement over the period of a month.

Compounded Monthly

A method of calculating interest where the interest earned on an investment is reinvested and earns additional interest in subsequent periods on a monthly basis.

Monthly Payments

Regular payments made over a set period of time, such as those for loans or subscriptions, calculated on a monthly basis.

Loan

An amount of money lent that must be repaid along with interest.

Q8: What was the absorption costing net operating

Q48: Knoke Corporation's contribution margin ratio is 29%

Q77: Fixed costs that are traceable to a

Q131: Matis Corporation's activity-based costing system has three

Q132: Bossie Corporation uses an activity-based costing system

Q133: Mccaskey Corporation uses an activity-based costing system

Q134: Smith Company sells a single product at

Q137: Mr. Earl Pearl, accountant for Margie Knall

Q195: Balbuena Corporation produces and sells two products.

Q238: Olis Corporation sells a product for $130