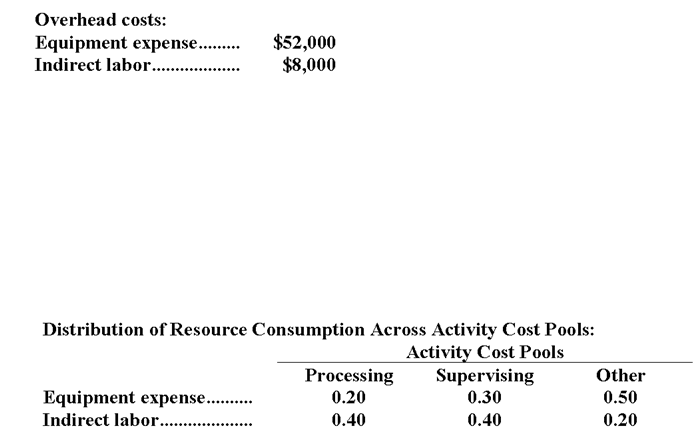

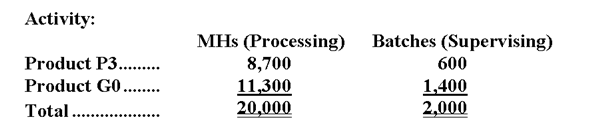

Roshannon Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts-equipment expense and indirect labor-to three activity cost pools-Processing, Supervising, and Other-based on resource consumption. Data to perform these allocations appear below:  In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

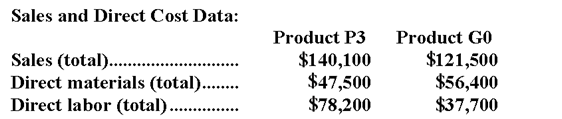

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:  Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

-What is the overhead cost assigned to Product P3 under activity-based costing?

Definitions:

Intra-entity Gross Profit

The profit made on transactions within the same company or between subsidiaries under the same parent company not yet realized outside the entity.

Equity Method

The Equity Method is an accounting technique used to record investments in associate companies, where the investment's carrying value is adjusted to recognize the investor's share of the associates' profits or losses.

Voting Common Stock

Shares of a company that grant the holder the right to vote on corporate matters at shareholder meetings.

Q2: What would be the effect on the

Q7: Assume that there is no other use

Q14: The management of Rodarmel Corporation is considering

Q39: The following data have been provided by

Q43: Lampshire Inc. is considering using stocks of

Q66: The activity rate for the Machining activity

Q77: The cost of goods sold that appears

Q86: To attain its desired ending cash balance

Q95: Under variable costing, the unit product cost

Q159: Segment margin is sales minus:<br>A)variable expenses.<br>B)traceable fixed