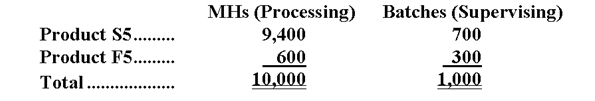

Umanzor Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $42,700; Supervising, $26,900; and Other, $17,400. Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

-The activity rate for the Processing activity cost pool under activity-based costing is closest to:

Definitions:

Disease

A state where an organism's normal functioning is disturbed, typically resulting in specific symptoms and signs.

Treatment

Medical care provided to a patient for an illness or injury, aimed at curing, relieving, or managing symptoms.

One-millionth

A fractional unit representing one part in a million of anything.

Gram

A metric unit of mass equal to one thousandth of a kilogram.

Q7: Gore Corporation has two divisions: the Business

Q19: Kinstle Inc. uses job-order costing. In September,

Q20: (Ignore income taxes in this problem.) The

Q39: The process of assigning overhead cost to

Q50: Murri Corporation has an activity-based costing system

Q68: A job cost sheet is used to

Q107: Higbie Corporation uses an activity-based costing system

Q119: If the materials handling cost is allocated

Q146: The unit product cost under variable costing

Q168: Under variable costing, the unit product cost