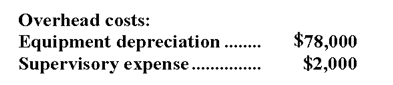

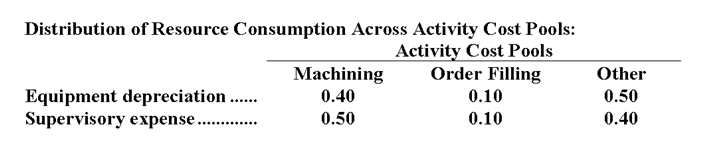

Capizzi Corporation has an activity-based costing system with three activity cost pools-Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to three activity cost pools based on resource consumption. Data used in the first stage allocations follow:

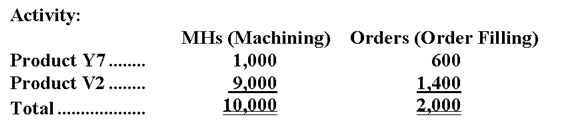

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

-The activity rate for the Order Filling activity cost pool under activity-based costing is closest to:

Definitions:

Tax Imposed

A financial charge or levy instituted by governmental authorities on individuals, transactions, or properties to generate revenue.

Buyer Bears

This concept refers to the condition in which the purchaser is responsible for any additional expenses that arise after a purchase agreement, such as repair or maintenance costs.

Price Wedge

The difference between the price paid by buyers and the price received by sellers, often resulting from taxes, subsidies, or other interventions in the market.

FICA

Stands for Federal Insurance Contributions Act, specific U.S. legislation that funds Social Security and Medicare through payroll taxes.

Q10: Eggins Inc. uses a job-order costing system

Q27: A manufacturing company that produces a single

Q31: Assume that if the component is purchased

Q34: The following monthly data are available for

Q65: When there is a production constraint, a

Q68: The activity rate for the Machining activity

Q91: (Ignore income taxes in this problem.) Mcclam,

Q154: Camren Corporation has two major business segments-Apparel

Q167: If the company increases its unit sales

Q174: Clayton Company produces a single product. Last