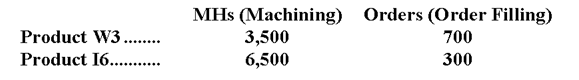

Figurski Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Machining, $38,500; Order Filling, $23,000; and Other, $15,500. Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

-The activity rate for the Order Filling activity cost pool under activity-based costing is closest to:

Definitions:

Variable Expenses

Expenses that change in proportion to the amount of goods produced or the volume of sales, including labor and materials.

Sales Territories

geographical or demographic areas assigned to sales representatives or teams to manage and cultivate customer relationships and sales activities.

Contribution Margin

The amount of revenue remaining after deducting variable costs, used to cover fixed costs and contribute to profit.

Variable Expenses

Expenditures that fluctuate in alignment with the quantity of production or sales figures, like labor costs and materials used.

Q44: (Ignore income taxes in this problem.) The

Q49: If Meacham decides to purchase the subcomponent

Q73: The sunk cost in this situation is:<br>A)$720,000<br>B)$160,000<br>C)$50,000<br>D)$100,000

Q76: Kach Corporation uses an activity-based costing system

Q80: If sales in Store Q increase by

Q82: If the internal rate of return exceeds

Q93: Schuppert Inc. uses a job-order costing system

Q181: Data concerning Odum Corporation's single product appear

Q208: The variable expense per unit is $12

Q232: The Herald Company manufactures and sells a