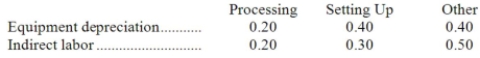

Yentzer Corporation has an activity-based costing system with three activity cost pools-Processing, Setting Up, and Other. The company's overhead costs consist of equipment depreciation and indirect labor and are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Equipment depreciation totals $72,000 and indirect labor totals $8,000. Data concerning the distribution of resource consumption across activity cost pools appear below:  Required:

Required:

Assign overhead costs to activity cost pools using activity-based costing.

Definitions:

Quarterly Sales

The total revenue or volume of sales achieved by a business within a three-month period.

Comma Usage

The rules governing the use of commas in written language to separate elements, clarify meaning, or indicate pauses.

Comma Usage

The application of commas in writing, serving to clarify meaning, indicate pauses, or separate elements within sentences.

Hard Work

Applying great effort, diligence, and persistence in doing something, often leading to achieving a goal or task.

Q4: What is the net monetary advantage (disadvantage)

Q7: The net present value of the proposed

Q31: What is the overhead cost assigned to

Q36: James Company has a margin of safety

Q46: Sandler Corporation bases its predetermined overhead rate

Q114: (Ignore income taxes in this problem) The

Q122: What was the absorption costing net operating

Q137: Mr. Earl Pearl, accountant for Margie Knall

Q153: Last year, Salada Corporation's variable costing net

Q220: Cindy, Inc. sells a product for $10