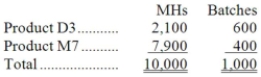

Irie Corporation has an activity-based costing system with three activity cost pools-Machining, Setting Up, and Other. The company's overhead costs have already been allocated to the cost pools and total $18,900 for the Machining cost pool, $20,500 for the Setting Up cost pool, and $23,600 for the Other cost pool. Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products appear below:  Required:

Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.

b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

Definitions:

Q6: The management of Niemeyer Corporation would like

Q12: A company anticipates a depreciation deduction of

Q13: What is the lowest selling price per

Q17: A company needs an increase in working

Q18: If the company bases its predetermined overhead

Q23: Kramer Company makes 4,000 units per year

Q24: The profitability index of investment project N

Q78: The activity rate for the Machining activity

Q108: A manufacturing company that produces a single

Q113: Data concerning Lancaster Corporation's single product appear