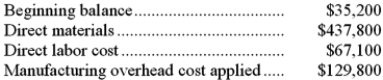

Pacey Inc. uses a job-order costing system in which any underapplied or overapplied overhead is closed to cost of goods sold at the end of the month. In April, the company completed job X69V that consisted of 11,000 units of one of the company's standard products. No other jobs were in process during the month. The job cost sheet for job X69V shows the following costs:  During the month, the actual manufacturing overhead cost incurred was $127,270 and 10,000 completed units from job X69V were sold. No other products were sold during the month. The unadjusted cost of goods sold (in other words, the cost of goods sold BEFORE adjustment for any underapplied or overapplied overhead) for April is closest to:

During the month, the actual manufacturing overhead cost incurred was $127,270 and 10,000 completed units from job X69V were sold. No other products were sold during the month. The unadjusted cost of goods sold (in other words, the cost of goods sold BEFORE adjustment for any underapplied or overapplied overhead) for April is closest to:

Definitions:

Department Manager

An individual responsible for overseeing a specific department's operations, budget, and staff within an organization.

Direct Material

Raw materials that can be directly attributed to the production of a specific product, part of the variable costs of manufacturing.

Manufacturing Overhead

Manufacturing overhead encompasses all the indirect costs associated with producing goods, such as utilities, depreciation, and salaries of support staff, that cannot be directly traced to specific products.

Direct Labor

The compensation given to workers directly engaged in creating goods or services.

Q2: Moeller Inc.'s inspection costs are listed below:

Q5: Yentzer Corporation has an activity-based costing system

Q23: To the nearest whole cent, what should

Q35: The following monthly data in contribution format

Q37: Suppose the price for the subcomponent has

Q88: A proposal has been made that will

Q92: The contribution margin per chair for the

Q98: What is the total period cost for

Q104: Data concerning Hewell Enterprises Corporation's single product

Q216: Hassick Corporation produces and sells a single