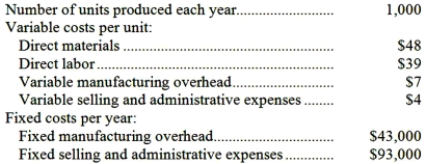

Hudalla Corporation produces a single product and has the following cost structure:  Required:

Required:

Compute the unit product cost under variable costing. Show your work!

Definitions:

Payroll Tax

Taxes imposed on employers and employees, calculated as a percentage of the salaries that employers pay their staff, used to fund social security and other government programs.

Corporate Income Tax

A tax imposed on the net income (profit) of corporations, calculated at a corporate tax rate.

Capital Intensive Techniques

Production methods that require a higher investment in physical capital rather than labor.

Q7: Using the least-squares regression method, the estimate

Q21: Refer to the original data in the

Q50: Under absorption costing, the unit product cost

Q51: The actual manufacturing overhead incurred at Hogans

Q57: Ribb Corporation produces and sells a single

Q59: Jumonville Company produces a single product. The

Q95: Heiny Inc. uses a job-order costing system

Q96: The amount of direct materials cost in

Q112: Assume the company's monthly target profit is

Q116: Irie Corporation has an activity-based costing system