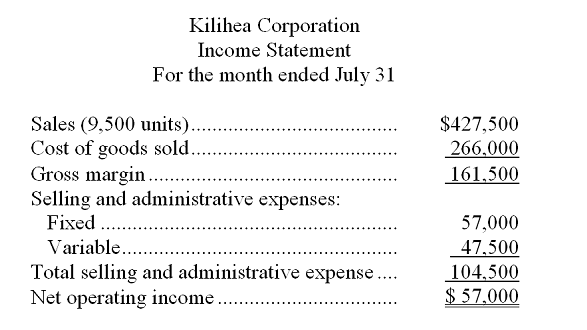

Kilihea Corporation produces a single product. The company's absorption costing income statement for July follows:  The company's variable production costs are $20 per unit and its fixed manufacturing overhead totals $80,000 per month.

The company's variable production costs are $20 per unit and its fixed manufacturing overhead totals $80,000 per month.

-Net operating income under the variable costing method for July would be:

Definitions:

Proportionate Interest Goodwill Method

An accounting method used to calculate goodwill in the consolidation of financial statements, based on the parent company's proportionate share in the net assets of the subsidiary.

Goodwill Impairment Losses

are losses recognized when the carrying amount of goodwill exceeds its recoverable amount.

Indirect NCI

Refers to a non-controlling interest in an entity that is owned through another subsidiary rather than directly.

Allocation of the Dividend

The process of distributing a portion of a company's earnings, decided by the board of directors, to its shareholders in proportion to their shareholding.

Q2: What is the unit product cost for

Q4: The margin of safety percentage is equal

Q14: Suppose an action analysis report is prepared

Q16: (Ignore income taxes in this problem.) The

Q20: How many units would the company have

Q34: The management of Therriault Corporation is considering

Q89: Daba Company manufactures two products, Product F

Q103: The present value of the annual cost

Q110: How much factory supervision and indirect factory

Q185: What is the company's degree of operating