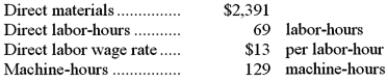

Job 731 was recently completed. The following data have been recorded on its job cost sheet:  The company applies manufacturing overhead on the basis of machine-hours. The predetermined overhead rate is $14 per machine-hour. The total cost that would be recorded on the job cost sheet for Job 731 would be:

The company applies manufacturing overhead on the basis of machine-hours. The predetermined overhead rate is $14 per machine-hour. The total cost that would be recorded on the job cost sheet for Job 731 would be:

Definitions:

Internal Equity

The practice of ensuring that employees are compensated fairly in relation to one another within the same organization.

Employee Benefits and Services

Various types of non-wage compensation provided to employees in addition to their salaries or wages, such as health insurance, retirement plans, and paid time off.

Tax-free Benefits

Fringe benefits provided by an employer to an employee that are exempt from taxation under current tax laws.

Employer-provided Insurance

Health or life insurance that is offered by an employer as part of an employment benefits package.

Q22: Dull Corporation has been producing and selling

Q51: At an activity level of 9,200 machine-hours

Q62: How much profit (loss) does the company

Q66: The activity rate for the Machining activity

Q70: The formula for computing the predetermined overhead

Q88: The cost of goods sold that is

Q100: The applied manufacturing overhead for the year

Q101: Jerston Company has an annual plant capacity

Q105: The advertising costs that Pepsi incurred to

Q128: Which product makes the MOST profitable use