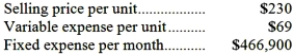

Data concerning Carlo Corporation's single product appear below:  The break-even in monthly dollar sales is closest to:

The break-even in monthly dollar sales is closest to:

Definitions:

Depreciation

Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life, reflecting the reduction in value over time.

Useful Life

The estimated period over which an asset is expected to be usable by the entity owning it, affecting depreciation calculations.

Adjusting Entries

At the end of an accounting interval, journal entries are made for the allocation of profits and expenses to the time frame in which they were genuinely incurred.

Prepaid Expenses

Payments made in advance for goods or services that will be used in the future, recorded as assets on the balance sheet until they are consumed.

Q7: Kelsh Company uses a predetermined overhead rate

Q17: The management of Gruwell Corporation would like

Q23: The marketing department believes that a promotional

Q25: Holding all other things constant, an increase

Q99: If Store Q sales increase by $30,000

Q102: Heminover Inc., which uses job-order costing, has

Q103: Which of the following would be considered

Q114: How much overhead cost is allocated to

Q155: A partial listing of costs incurred at

Q189: Butteco Corporation has provided the following cost