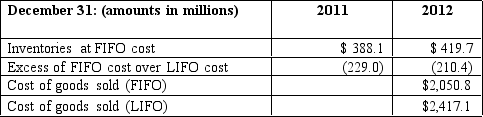

A large manufacturer recently changed its cost-flow assumption method for inventories at the beginning of 2012.The manufacturer has been in operation for almost 40 years,and for the last decade,it has reported moderate growth in revenues.The firm changed from the LIFO method to the FIFO method and reported the following information:

Calculate the inventory turnover ratio for 2012 using the LIFO and FIFO cost-flow assumption methods.Explain why the costs assigned to inventory under LIFO at the end of 2011 and 2012 are so much less than they are under FIFO.

Calculate the inventory turnover ratio for 2012 using the LIFO and FIFO cost-flow assumption methods.Explain why the costs assigned to inventory under LIFO at the end of 2011 and 2012 are so much less than they are under FIFO.

Definitions:

Distance

The amount of space between two points, measured physically or conceptually.

Details

specific pieces of information or features that contribute to a fuller or more precise understanding of a topic or situation.

Buying Behavior

The decision processes and acts of people involved in buying and using products.

A professional networking platform allowing individuals and organizations to connect and share opportunities.

Q4: A large manufacturer recently changed its cost-flow

Q7: The ability of a firm to generate

Q15: Simmons Company<br>These data represent a summary of

Q28: If dividend projections include the effect of

Q40: Office Mart,Inc.sells numerous office supply products through

Q43: The use of P/E ratios in valuation

Q47: An analyst can view the revenues to

Q55: A disadvantage of the free cash flow

Q57: For the following types of companies,discuss whether

Q81: Time-series analysis helps answer all of the