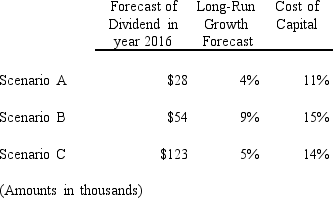

For each of the following scenarios determine the value as of the beginning of 2012 of the continuing dividend:

Definitions:

Debt-Equity Ratio

A financial ratio portraying the comparative financing approach using debt and equity for assets.

Plowback Ratio

The proportion of earnings that a company retains and reinvests into its operations rather than distributing as dividends.

Dividend Payout Ratio

The fraction of net income a firm pays to its shareholders in dividends, expressed as a percentage.

Operating Capacity

The maximum output or production level that a facility or business can achieve under normal circumstances.

Q4: The residual income _ valuation model uses

Q35: Implementing a dividend valuation model to determine

Q42: Under IFRS,cash payments for purchase of treasury

Q45: Firms recognize a(n)_ when the carrying amount

Q45: The conceptual framework for free cash flows

Q48: Accountants use reserve accounts for various reasons,for

Q54: The rationale for adding back the _

Q55: Analysts use the PEG ratio to assess

Q59: Explain "free" cash flows.Describe which types of

Q64: Univariate bankruptcy prediction models help identify factors