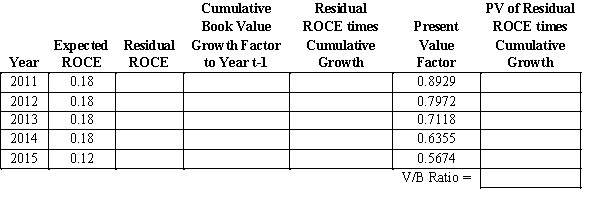

Assume an analyst is evaluating a firm with $1,000 of book value of common equity and a cost of equity capital equal to 12 percent.Assume that the analyst forecasts that the firm will earn ROCE of 18 percent until year 2015,when the firm will start earning ROCE equal to 12 percent.The company pays no dividends and will not engage in any stock transactions.Use this information to complete the following table and calculate the firm's value-to-book ratio.

Definitions:

Cash Requirements

Cash requirements refer to the total amount of cash a company needs to satisfy its operational expenses and financial obligations in a given period.

Long-Term Debt

Loans and financial obligations lasting more than one year, used as a means for business financing.

Corporate Ownership

Refers to the ownership of shares in a corporation, which represents claims on the corporation's assets and earnings.

Ability To Raise Capital

The capacity of a company to secure funds for its operations, growth, or to meet financial obligations, through debt, equity, or other financial instruments.

Q4: Assume that Hsu Company needs to acquire

Q5: A derivative has one or more _,which

Q7: At January 1,2012,Porter should record an asset

Q12: The differences in industry market-to-book ratios may

Q19: Examine the five following cases and determine

Q26: An analyst using the inventory turnover ratio

Q31: Under which of the following conditions does

Q38: Equity valuation models based on dividends,cash flows,and

Q40: To calculate a company's average tax rate

Q91: Firms recognize an impairment loss when the