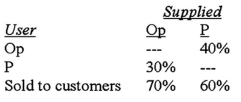

Computer Complex,Inc.has two main services: (1) time on a timeshared computer system,and (2) proprietary computer programs.Computer time is provided by the operation department (Op) and programs are written by the programming department (P) The percentage of each service used by each department for a typical period is:  In a typical period,the operation department (Op) spends $4,500 and the programming department (P) spends $2,500.Under the reciprocal method what is the algebraic solution to the cost allocation problem?

In a typical period,the operation department (Op) spends $4,500 and the programming department (P) spends $2,500.Under the reciprocal method what is the algebraic solution to the cost allocation problem?

Definitions:

Goodwill Impairment

A reduction in the book value of goodwill, which occurs when the carrying amount of goodwill exceeds its fair value, indicating that the asset is not as valuable as previously thought.

Reporting Units

Segments or components of a business for which discrete financial information is available and reviewed by the operating segment's management.

Equity Method

An accounting technique used by a company to record its investment in another company, where the investment's value is adjusted in accordance with the investee's performance.

Partial Equity Method

An accounting method used for investments, where the investor recognizes its share of the investee's earnings, but adjustments are less comprehensive than under the full equity method.

Q7: Pardee Company makes 30% of its sales

Q17: Which of the following is not a

Q26: Scottso Enterprises has identified the following overhead

Q29: The following set up is a system

Q35: Yellow Industries decides to price delivery service

Q45: Economic value added (EVA)assumes that which of

Q57: Products X,Y,and Z are produced from the

Q58: A favorable variance is not necessarily good,and

Q67: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2418/.jpg" alt=" What is the

Q91: Brandeis Corporation has two production Departments: P1