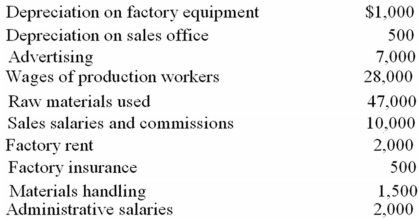

The following cost data for the month of May were taken from the records of the Paducah Manufacturing Company: (CIA adapted)  Based upon this information,the manufacturing cost incurred during the month was:

Based upon this information,the manufacturing cost incurred during the month was:

Definitions:

Income Tax Expense

The accounting expense associated with the income taxes a company is obligated to pay to governmental authorities based on its taxable income.

Tax Rate

A percentage at which an individual or corporation is taxed; the tax authority sets it, and it can vary based on income, property value, sales price, etc.

Business Combination

The coming together of separate entities or businesses into one reporting entity via a merger, acquisition, or consolidation.

Business Combination

The process of merging two or more companies into one, through various forms such as mergers, acquisitions, or consolidations.

Q10: The practice of setting prices highest when

Q27: (CIA adapted)The primary reason for adopting total

Q28: Break-even analysis assumes that over the relevant

Q36: During which step of the value chain

Q36: Lo-crete produces quick setting concrete mix.Production of

Q36: The engineering method of determining cost behavior

Q57: Before prorating the manufacturing overhead costs at

Q64: Fowler Manufacturing Company has a fixed cost

Q96: Cheboygan Company has the following unit costs:

Q108: Which of the following does not represent