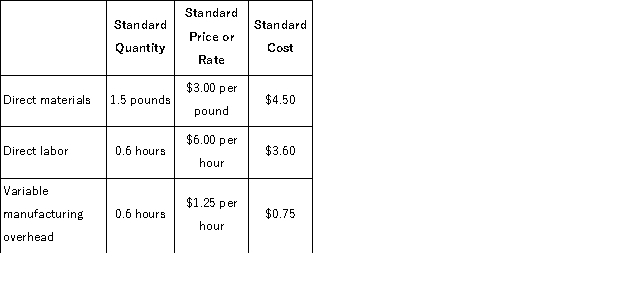

Pardoe, Inc. , manufactures a single product in which variable manufacturing overhead is assigned on the basis of standard direct labor-hours.The company uses a standard cost system and has established the following standards for one unit of product:  During March, the following activity was recorded by the company: • The company produced 3, 000 units during the month.

During March, the following activity was recorded by the company: • The company produced 3, 000 units during the month.

• A total of 8, 000 pounds of material were purchased at a cost of $23, 000.

• There was no beginning inventory of materials on hand to start the month;at the end of the month, 2, 000 pounds of material remained in the warehouse.

• During March, 1, 600 direct labor-hours were worked at a rate of $6.50 per hour.

• Variable manufacturing overhead costs during March totaled $1, 800.

The direct materials purchases variance is computed when the materials are purchased.

The variable overhead rate variance for March is:

Definitions:

Supply Curves

A graphical representation showing the relationship between the price of a good and the amount of it that producers are willing to supply.

Excise Tax

A tax levied on specific goods, services, or transactions, often included in the price of products like gasoline, alcohol, and tobacco.

Demand Curves

Charts displaying the correlation between a product's price and the amount of that product buyers are ready and capable of buying at different price levels.

Q4: Longview Hospital performs blood tests in its

Q6: Larance Detailing's cost formula for its materials

Q7: Health disparities are inequalities that exist when

Q16: Aiza is the wife of 52-year-old Hasan,

Q17: Tammo Jeep Tours operates jeep tours in

Q74: Trumbull Corporation budgeted sales on account of

Q98: Bracken Corporation is a small wholesaler of

Q100: Emerich Corporation keeps careful track of the

Q113: The North Division of the Lyman Company

Q153: Biery Corporation makes a product with the