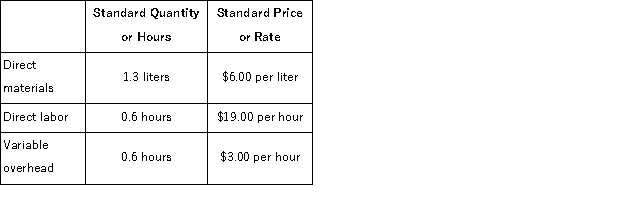

Biery Corporation makes a product with the following standard costs:  The company produced 4, 100 units in April using 5, 380 liters of direct material and 2, 610 direct labor-hours.During the month, the company purchased 6, 000 liters of the direct material at $5.80 per liter.The actual direct labor rate was $19.80 per hour and the actual variable overhead rate was $2.90 per hour. The company applies variable overhead on the basis of direct labor-hours.The direct materials purchases variance is computed when the materials are purchased.

The company produced 4, 100 units in April using 5, 380 liters of direct material and 2, 610 direct labor-hours.During the month, the company purchased 6, 000 liters of the direct material at $5.80 per liter.The actual direct labor rate was $19.80 per hour and the actual variable overhead rate was $2.90 per hour. The company applies variable overhead on the basis of direct labor-hours.The direct materials purchases variance is computed when the materials are purchased.

The labor rate variance for April is:

Definitions:

Fair Labor Standards Act

A U.S. law that sets minimum wage, overtime pay eligibility, recordkeeping, and child labor standards affecting full-time and part-time workers in the private sector and in federal, state, and local governments.

Time and a Half

A payment rate that is 1.5 times the employee's regular hourly rate, typically paid for overtime work.

Federal Insurance Contributions Act

U.S. legislation that funds Social Security and Medicare through payroll taxes imposed on both employers and employees.

FICA

The Federal Insurance Contributions Act, which mandates a payroll tax to fund Social Security and Medicare in the United States.

Q5: Canevari Corporation makes a product that uses

Q7: The materials price variance is computed by

Q12: Only variable manufacturing overhead costs are included

Q43: Zelenka Clinic uses client-visits as its measure

Q85: The manufacturing overhead budget lists all costs

Q111: For the past year, Allargando Company recorded

Q153: Biery Corporation makes a product with the

Q214: Wragg Urban Diner is a charity supported

Q279: Which of the following is an example

Q295: Liscomb Tech is a for-profit vocational school.The