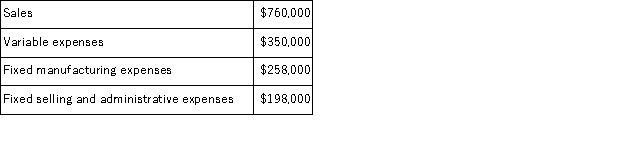

The management of Cackowski Corporation has been concerned for some time with the financial performance of its product I11S and has considered discontinuing it on several occasions.Data from the company's accounting system appear below:  In the company's accounting system all fixed expenses of the company are fully allocated to products.Further investigation has revealed that $185, 000 of the fixed manufacturing expenses and $132, 000 of the fixed selling and administrative expenses are avoidable if product I11S is discontinued. What would be the effect on the company's overall net operating income if product I11S were dropped?

In the company's accounting system all fixed expenses of the company are fully allocated to products.Further investigation has revealed that $185, 000 of the fixed manufacturing expenses and $132, 000 of the fixed selling and administrative expenses are avoidable if product I11S is discontinued. What would be the effect on the company's overall net operating income if product I11S were dropped?

Definitions:

Producer

An organism, typically a plant or algae, that synthesizes organic compounds from simple substances like carbon dioxide, serving as a fundamental part of the food chain by providing energy for consumers.

Nitrogen

A chemical element with symbol N and atomic number 7, essential for all living organisms.

Denitrification

Conversion of nitrates or nitrites to nitrogen gas.

Nitrogen Fixation

The process by which certain microorganisms convert atmospheric nitrogen into a form that can be used by plants to synthesize proteins and nucleic acids.

Q3: Acton Corporation, which applies manufacturing overhead on

Q19: Joint products are products that are sold

Q62: Organization-sustaining overhead costs should be allocated to

Q63: Which of the following would probably be

Q87: Carter Lumber sells lumber and general building

Q91: Noel Enterprises has budgeted sales in units

Q130: Fimbrez Corporation has provided the following data

Q133: Crystal Corporation produces a single product.The company's

Q149: Jebb's Lettuce Stand currently sells 60, 000

Q162: Routsong Corporation had the following sales and