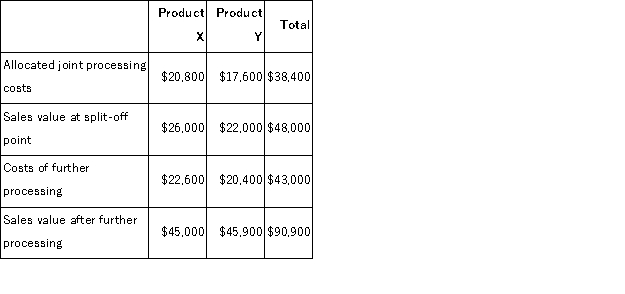

Dowchow Corporation makes two products from a common input.Joint processing costs up to the split-off point total $38, 400 a year.The company allocates these costs to the joint products on the basis of their total sales values at the split-off point.Each product may be sold at the split-off point or processed further.Data concerning these products appear below:  What is the net monetary advantage (disadvantage) of processing Product X beyond the split-off point?

What is the net monetary advantage (disadvantage) of processing Product X beyond the split-off point?

Definitions:

Prosecute Criminally

The process by which a government attorney brings charges against a person or entity for breaking the law.

Comparative Law

The study of differences and similarities between the law of different countries or legal systems.

International Expansion

The process by which a business grows beyond its home country, entering new markets globally.

Employment Practices

Policies and practices related to the management of individuals in a workplace setting, including hiring, training, evaluating, and terminating employees.

Q16: Acton Corporation, which applies manufacturing overhead on

Q30: Two or more products produced from a

Q42: Noel Enterprises has budgeted sales in units

Q90: Peterson Corporation produces a single product.Data from

Q97: A continuous or perpetual budget is a

Q110: Under absorption costing, fixed manufacturing overhead costs:<br>A)are

Q111: Harris, Inc. , has budgeted sales in

Q114: In traditional costing, some manufacturing costs may

Q144: Rollison Corporation has two divisions: Retail Division

Q189: When using segmented income statements, the dollar