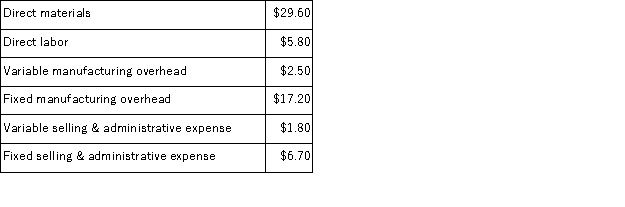

Juett Company produces a single product.The cost of producing and selling a single unit of this product at the company's normal activity level of 70, 000 units per month is as follows:  The normal selling price of the product is $72.90 per unit.

The normal selling price of the product is $72.90 per unit.

An order has been received from an overseas customer for 2, 000 units to be delivered this month at a special discounted price.This order would have no effect on the company's normal sales and would not change the total amount of the company's fixed costs.The variable selling and administrative expense would be $1.10 less per unit on this order than on normal sales.

Direct labor is a variable cost in this company.

Required:

a.Suppose there is ample idle capacity to produce the units required by the overseas customer and the special discounted price on the special order is $66.10 per unit.By how much would this special order increase (decrease)the company's net operating income for the month?

b.Suppose the company is already operating at capacity when the special order is received from the overseas customer.What would be the opportunity cost of each unit delivered to the overseas customer?

c.Suppose there is not enough idle capacity to produce all of the units for the overseas customer and accepting the special order would require cutting back on production of 1, 300 units for regular customers.What would be the minimum acceptable price per unit for the special order?

Definitions:

Petty Cash

A small amount of cash kept on hand used for paying minor or incidental expenses in a business setting.

Postage Expense

The cost incurred by a business for sending mail.

Role Expectations

Social norms regarding the behaviors and responsibilities associated with a particular social status or position.

Stepfamily Members

Individuals who become part of a family unit through the remarriage of a parent, including stepparents and stepchildren.

Q6: (Ignore income taxes in this problem. )Baldock

Q11: A customer has requested that Gamba Corporation

Q18: (Ignore income taxes in this problem. )Boyson,

Q43: Manton Corporation uses an activity based costing

Q65: (Ignore income taxes in this problem. )Overland

Q92: The Weston Corporation is analyzing projects A,

Q94: (Ignore income taxes in this problem. )Chee

Q114: The Covey Corporation is preparing its Manufacturing

Q138: Under absorption costing, the profit for a

Q205: Warburton Corporation has two divisions: Alpha and