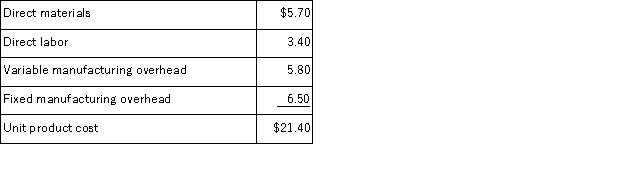

A customer has requested that Gamba Corporation fill a special order for 3, 000 units of product Q41 for $25.00 a unit.While the product would be modified slightly for the special order, product Q41's normal unit product cost is $21.40:  Direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like modifications made to product Q41 that would increase the variable costs by $7.00 per unit and that would require an investment of $15, 000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.If the special order is accepted, the company's overall net operating income would increase (decrease) by:

Direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like modifications made to product Q41 that would increase the variable costs by $7.00 per unit and that would require an investment of $15, 000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.If the special order is accepted, the company's overall net operating income would increase (decrease) by:

Definitions:

Investing Cash Flows

Part of the cash flow statement that shows the cash spent on and received from investment activities, including assets purchases and sales.

Acquisition of Subsidiary

The process of obtaining control of another company, which then becomes a subsidiary, often involving the purchase of its shares.

Income Taxes Paid

The total amount of money a company pays in taxes to various tax authorities based on its taxable income.

Investing Activities

Activities concerning the acquisition and disposal of long-term assets and other investments not included in cash equivalents.

Q18: Farron Corporation, which has only one product,

Q37: Munar Corporation uses activity-based costing to compute

Q54: A sales budget is given below for

Q83: Ramon Corporation makes 18, 000 units of

Q115: (Ignore income taxes in this problem. )Baber

Q124: Harris, Inc. , has budgeted sales in

Q128: Discounted cash flow techniques do not take

Q144: Rollison Corporation has two divisions: Retail Division

Q147: (Ignore income taxes in this problem. )The

Q167: Yankee Corporation manufactures a single product.The company