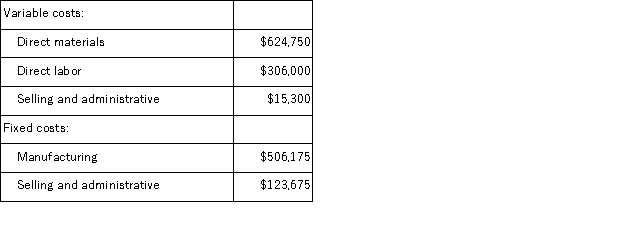

Adamyan Co.manufactures and sells medals for winners of athletic and other events.Its manufacturing plant has the capacity to produce 15, 000 medals each month;current monthly production is 12, 750 medals.The company normally charges $120 per medal.Cost data for the current level of production are shown below:  The company has just received a special one-time order for 700 medals at $83 each.For this particular order, no variable selling and administrative costs would be incurred.This order would also have no effect on fixed costs.

The company has just received a special one-time order for 700 medals at $83 each.For this particular order, no variable selling and administrative costs would be incurred.This order would also have no effect on fixed costs.

Required:

Should the company accept this special order? Why?

Definitions:

Selling Expenses

Selling expenses are costs associated with the selling of a company’s products or services, including advertising, sales commissions, and store maintenance.

Accounts Payable

Accounts payable are short-term liabilities representing money a company owes to suppliers or creditors for products and services received but not yet paid for.

Accounts Receivable

The money owed to a company by its customers for goods or services that have been delivered or used but not yet paid for.

Cash Collections

The process of receiving payment from customers for goods or services provided, impacting the company’s cash flow.

Q24: Nantua Corporation has two divisions, Southern and

Q33: A self-imposed budget is a budget that

Q70: Consider the following production and cost data

Q76: Mujalli Corporation is considering a capital budgeting

Q81: Pabbatti Corporation, which has only one product,

Q93: Caber Corporation applies manufacturing overhead on the

Q96: Common fixed expenses should be allocated to

Q128: Aholt Corporation makes 40, 000 units per

Q139: Aaker Corporation, which has only one product,

Q202: Delvin Corporation, which has only one product,