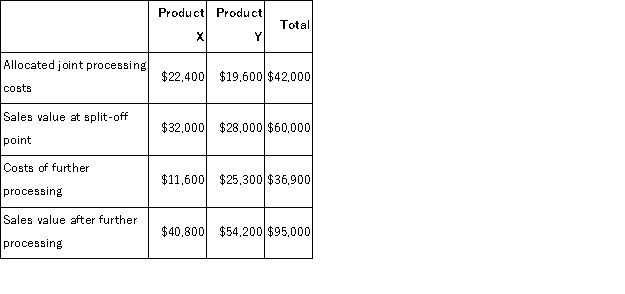

Iaci Company makes two products from a common input.Joint processing costs up to the split-off point total $42, 000 a year.The company allocates these costs to the joint products on the basis of their total sales values at the split-off point.Each product may be sold at the split-off point or processed further.Data concerning these products appear below:  Required:

Required:

a.What is the net monetary advantage (disadvantage)of processing Product X beyond the split-off point?

b.What is the net monetary advantage (disadvantage)of processing Product Y beyond the split-off point?

c.What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

d.What is the minimum amount the company should accept for Product Y if it is to be sold at the split-off point?

Definitions:

Revenue Centre Manager

An individual responsible for overseeing a business unit or division that is focused on generating revenue, without direct control over costs or investment decisions.

Gross Margin

A company's revenue minus its cost of goods sold, expressed as a percentage of revenues, indicating the efficiency of production and sales.

Transfer Price

The price at which goods and services are sold between divisions within the same company, used for internal sales and profit allocation.

Variable Cost

Costs that change in proportion to the goods or services that a business produces.

Q5: (Ignore income taxes in this problem. )Jergenson

Q7: (Ignore income taxes in this problem. )Cascade,

Q14: Juett Company produces a single product.The cost

Q35: (Ignore income taxes in this problem. )The

Q48: If the actual manufacturing overhead cost for

Q56: When making preference decisions about competing investment

Q134: (Ignore income taxes in this problem. )Naomi

Q168: May Corporation, a merchandising firm, has budgeted

Q172: The Covey Corporation is preparing its Manufacturing

Q211: Sosinski Corporation has two divisions: Domestic Division