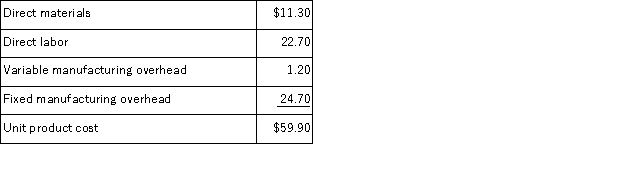

Aholt Corporation makes 40, 000 units per year of a part it uses in the products it manufactures.The unit product cost of this part is computed as follows:  An outside supplier has offered to sell the company all of these parts it needs for $46.20 a unit.If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand.The additional contribution margin on this other product would be $264, 000 per year. If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided.However, $21.90 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier.This fixed manufacturing overhead cost would be applied to the company's remaining products.

An outside supplier has offered to sell the company all of these parts it needs for $46.20 a unit.If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand.The additional contribution margin on this other product would be $264, 000 per year. If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided.However, $21.90 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier.This fixed manufacturing overhead cost would be applied to the company's remaining products.

What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 40, 000 units required each year?

Definitions:

Inflexibility

The lack of adaptability or willingness to change one's thoughts, actions, or decisions in response to new information or circumstances.

Self-Efficacy

An individual's belief in their own capacity to execute behaviors necessary to produce specific performance attainments, influencing how one feels, thinks, and acts.

Preoccupation

A state of being absorbed with thoughts or concerns about a specific issue or task, often to the exclusion of other considerations.

Tech-Support Center

A service facility dedicated to providing assistance and support for technology-related problems or inquiries, often through help desks or call centers.

Q11: (Ignore income taxes in this problem. )Ataxia

Q54: Koutz Corporation uses activity-based costing to compute

Q97: A continuous or perpetual budget is a

Q103: Tish Corporation produces a part used in

Q110: Under absorption costing, fixed manufacturing overhead costs:<br>A)are

Q147: Khanam Corporation, which has only one product,

Q155: (Ignore income taxes in this problem. )Carlson

Q167: Palinkas Cane Products Inc. , processes sugar

Q168: Under variable costing, variable production costs are

Q189: When using segmented income statements, the dollar