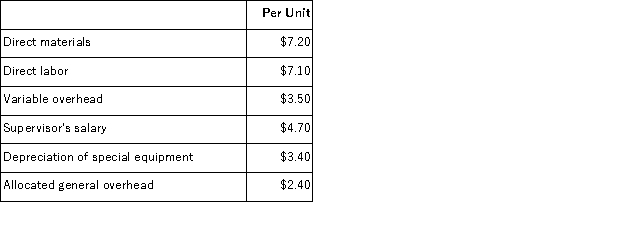

Kerbow Corporation uses part B76 in one of its products.The company's Accounting Department reports the following costs of producing the 12, 000 units of the part that are needed every year.  An outside supplier has offered to make the part and sell it to the company for $27.40 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $6, 000 of these allocated general overhead costs would be avoided.In addition, the space used to produce part B76 could be used to make more of one of the company's other products, generating an additional segment margin of $29, 000 per year for that product.

An outside supplier has offered to make the part and sell it to the company for $27.40 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $6, 000 of these allocated general overhead costs would be avoided.In addition, the space used to produce part B76 could be used to make more of one of the company's other products, generating an additional segment margin of $29, 000 per year for that product.

Required:

a.Prepare a report that shows the effect on the company's total net operating income of buying part B76 from the supplier rather than continuing to make it inside the company.

b.Which alternative should the company choose?

Definitions:

Skokie, Illinois

A village in Illinois, known for a significant legal case involving a Nazi group's right to march, raising issues of free speech and community standards.

Accused of a Crime

The state or condition of being charged with a criminal offense by legal authorities.

Supreme Court

The highest federal court in the United States, endowed with the judicial power to interpret and apply the Constitution, thereby shaping the nation's laws and society.

Death Penalty

The death penalty is a legal punishment where a person is put to death by the state as a penalty for a crime.

Q36: The internal rate of return for a

Q59: Buth Inc.uses a job-order costing system in

Q77: Dapper Corporation had only one job in

Q92: LFM Corporation makes and sells a product

Q101: Falsetta Corporation makes three products that use

Q118: The budgeted selling and administrative expense is

Q119: Dockwiller Inc.manufactures industrial components.One of its products,

Q123: The management of Cackowski Corporation has been

Q147: (Ignore income taxes in this problem. )The

Q153: (Ignore income taxes in this problem. )Chee