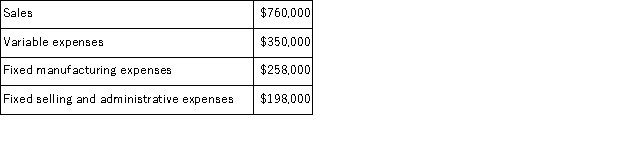

The management of Cackowski Corporation has been concerned for some time with the financial performance of its product I11S and has considered discontinuing it on several occasions.Data from the company's accounting system appear below:  In the company's accounting system all fixed expenses of the company are fully allocated to products.Further investigation has revealed that $185, 000 of the fixed manufacturing expenses and $132, 000 of the fixed selling and administrative expenses are avoidable if product I11S is discontinued. According to the company's accounting system, what is the net operating income earned by product I11S? Include all costs in this calculation-whether relevant or not.

In the company's accounting system all fixed expenses of the company are fully allocated to products.Further investigation has revealed that $185, 000 of the fixed manufacturing expenses and $132, 000 of the fixed selling and administrative expenses are avoidable if product I11S is discontinued. According to the company's accounting system, what is the net operating income earned by product I11S? Include all costs in this calculation-whether relevant or not.

Definitions:

Branding

The process of creating a unique image, identity, and reputation for a product, service, or organization in the consumer's mind through marketing, logos, design, and consistent themes.

Administration

The process of organizing and managing tasks, operations, or duties within an organization to achieve set objectives effectively.

Sales

The activity or business of selling products or services to customers.

Virtual Teams

Groups of individuals from different locations work together through e-mail, video conferencing, instant messaging, and other electronic media.

Q1: Vontungeln Corporation uses activity-based costing to compute

Q26: Bateman Corporation, which has only one product,

Q36: The Talbot Corporation makes wheels that it

Q38: Meyer Corporation has two sales areas: North

Q63: Paradise Corporation budgets on an annual basis

Q66: Kerbow Corporation uses part B76 in one

Q87: Brown Corporation makes four products in a

Q108: During its first year of operations, Carlos

Q136: (Ignore income taxes in this problem. )The

Q156: Chown Corporation, which has only one product,