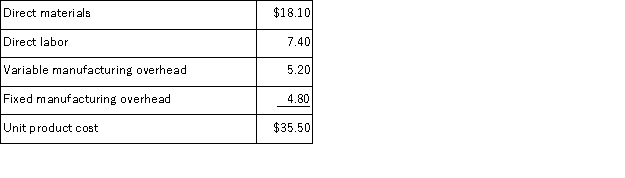

Tullius Corporation has received a request for a special order of 8, 000 units of product C64 for $50.00 each.The normal selling price of this product is $53.25 each, but the units would need to be modified slightly for the customer.The normal unit product cost of product C64 is computed as follows:  Direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like some modifications made to product C64 that would increase the variable costs by $5.00 per unit and that would require a one-time investment of $43, 000 in special molds that would have no salvage value.This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.

Direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like some modifications made to product C64 that would increase the variable costs by $5.00 per unit and that would require a one-time investment of $43, 000 in special molds that would have no salvage value.This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.

Required:

Determine the effect on the company's total net operating income of accepting the special order.Show your work!

Definitions:

Utilitarian Value

The usefulness or practical benefit of something, especially regarding the greatest happiness or benefit to the greatest number of people.

Vulnerable Habitats

Ecosystems or environments that are at risk of degradation, damage, or destruction due to human activities, climate change, or natural phenomena, requiring special attention for conservation.

Endangered

Refers to species that are at risk of extinction due to a significant decline in population or habitat.

Fruit-Eating Bats

Bat species that play a crucial role in ecosystems by pollinating plants and dispersing seeds while feeding on fruit.

Q2: Crystal Corporation produces a single product.The company's

Q29: Cowles Corporation, Inc.makes and sells a single

Q47: The management of Kabanuck Corporation is considering

Q47: During its first year of operations, Carlos

Q70: Aaker Corporation, which has only one product,

Q91: (Ignore income taxes in this problem. )The

Q102: (Ignore income taxes in this problem. )Dube

Q104: The following are budgeted data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2487/.jpg"

Q123: (Ignore income taxes in this problem. )Consider

Q167: Palinkas Cane Products Inc. , processes sugar