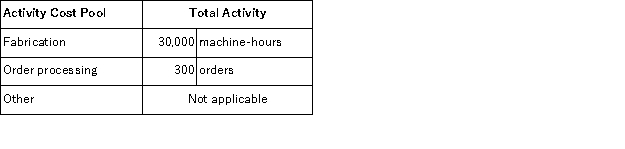

Hochberg Corporation uses an activity-based costing system with the following three activity cost pools:  The Other activity cost pool is used to accumulate costs of idle capacity and organization-sustaining costs. The company has provided the following data concerning its costs:

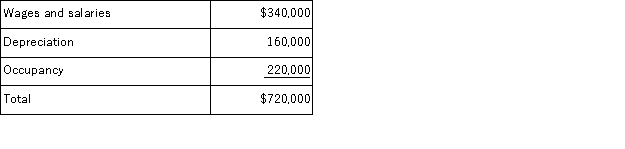

The Other activity cost pool is used to accumulate costs of idle capacity and organization-sustaining costs. The company has provided the following data concerning its costs:  The distribution of resource consumption across activity cost pools is given below:

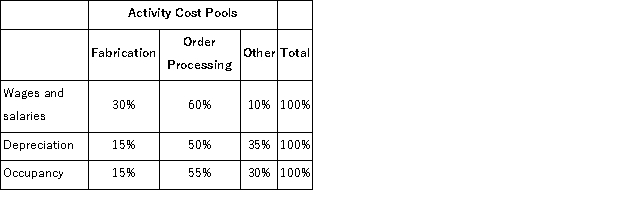

The distribution of resource consumption across activity cost pools is given below:  The activity rate for the Fabrication activity cost pool is closest to:

The activity rate for the Fabrication activity cost pool is closest to:

Definitions:

Form 941

A U.S. tax form used by employers to report quarterly federal payroll taxes.

Note Payable

A written promise to pay a specified amount of money, usually with interest, by a certain date, representing a liability.

Interest Expense

The cost incurred by an entity for borrowed funds over a period, often shown on the income statement.

Face Value

The nominal or dollar value printed on a security or financial instrument, representing its legal value.

Q7: Aaker Corporation, which has only one product,

Q13: Carlton Corporation sells a single product at

Q42: Carsten Wedding Fantasy Corporation makes very elaborate

Q45: Cartier Inc.bases its manufacturing overhead budget on

Q68: Holdt Inc.produces and sells a single product.The

Q89: Fife & Jones PLC, a consulting firm,

Q91: Noel Enterprises has budgeted sales in units

Q119: Dockwiller Inc.manufactures industrial components.One of its products,

Q134: In activity-based costing, organization-sustaining costs should be

Q138: Under absorption costing, the profit for a