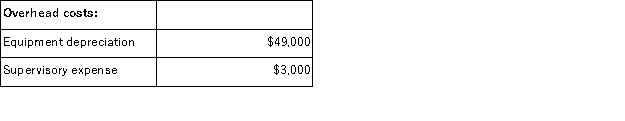

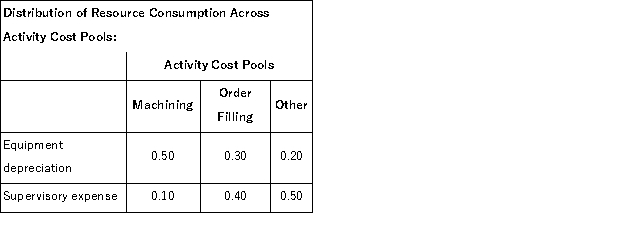

Betterton Corporation uses an activity based costing system to assign overhead costs to products.In the first stage, two overhead costs-equipment depreciation and supervisory expense-are allocated to three activity cost pools-Machining, Order Filling, and Other-based on resource consumption.Data to perform these allocations appear below:

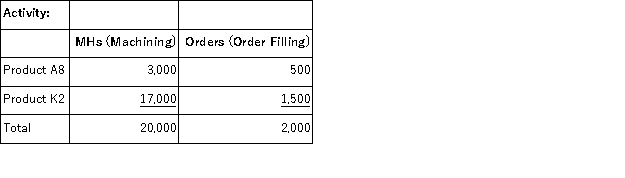

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  The activity rate for the Machining activity cost pool under activity-based costing is closest to:

The activity rate for the Machining activity cost pool under activity-based costing is closest to:

Definitions:

Goal-Sharing Plans

A type of incentive plan where employees are rewarded if collective goals are achieved, promoting teamwork and collaboration.

Employee Participation

A workplace practice where employees are involved in decision-making processes, potentially improving satisfaction and productivity.

Phantom Stock Plan

A type of employee benefit plan that gives selected employees many of the benefits of stock ownership without giving them any company stock, often tied to the performance or value of the company's stock.

Company Stock

Shares of ownership in a corporation, representing a claim on part of the corporation's assets and earnings.

Q52: Duarte Corporation processes sugar beets that it

Q61: Adi Manufacturing Corporation is estimating the following

Q68: Studler Corporation has an activity-based costing system

Q70: Conely Corporation has provided the following data

Q81: (Ignore income taxes in this problem. )Allen

Q124: Tullius Corporation has received a request for

Q136: Eley Corporation produces a single product.The cost

Q153: (Ignore income taxes in this problem. )Chee

Q180: Maack Corporation's contribution margin ratio is 16%

Q213: Roskos Corporation has two divisions: Town Division