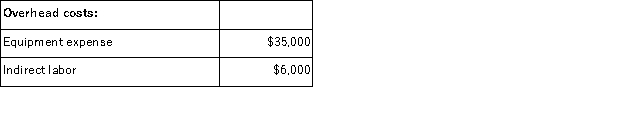

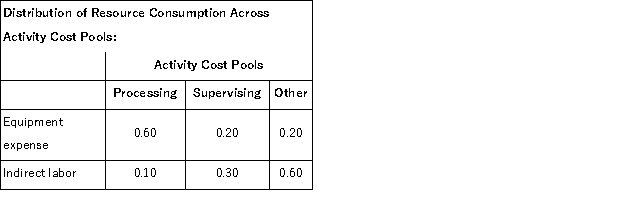

Manton Corporation uses an activity based costing system to assign overhead costs to products.In the first stage, two overhead costs-equipment expense and indirect labor-are allocated to the three activity cost pools-Processing, Supervising, and Other-based on resource consumption.Data to perform these allocations appear below:

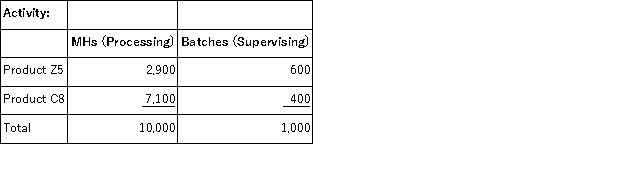

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

Definitions:

Task-Oriented Conflicts

Conflicts arising from differences in opinions or approaches towards accomplishing a specific task or goal.

Escalation Of Commitment

A decision-making process where individuals or groups continue to invest in a decision despite new evidence suggesting it might be wrong.

Sunk Costs

Expenses that have already been incurred and cannot be recovered, which should not affect future decision-making but often do.

External Review

An evaluation or assessment conducted by individuals or entities outside of an organization to ensure objectivity and impartiality, often focusing on processes, products, or financial health.

Q19: Hatfield Corporation, which has only one product,

Q61: Caber Corporation applies manufacturing overhead on the

Q68: Holdt Inc.produces and sells a single product.The

Q70: Darwin Inc.sells a particular textbook for $20.Variable

Q88: If a company operates at the break

Q92: LFM Corporation makes and sells a product

Q94: Kosco Corporation produces a single product.The company's

Q111: Sales in North Corporation increased from $60,

Q125: Weldon Industrial Gas Corporation supplies acetylene and

Q157: (Ignore income taxes in this problem. )Crowley