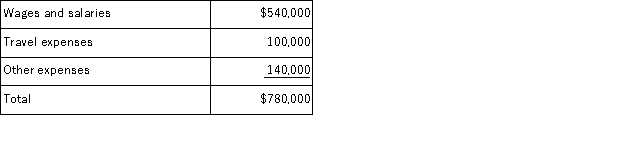

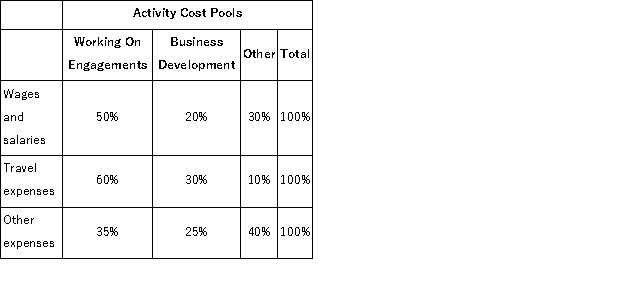

Fife & Jones PLC, a consulting firm, uses an activity-based costing in which there are three activity cost pools.The company has provided the following data concerning its costs and its activity based costing system:

Costs:  Distribution of resource consumption:

Distribution of resource consumption:  Required:

Required:

a.How much cost, in total, would be allocated to the Working On Engagements activity cost pool?

b.How much cost, in total, would be allocated to the Business Development activity cost pool?

c.How much cost, in total, would be allocated to the Other activity cost pool?

Definitions:

Specific Performance

A legal remedy where the court orders a party to fulfill their obligations under a contract, as opposed to awarding damages.

Waiver

A waiver is the voluntary relinquishment or surrender of some known right or privilege.

Supervening Illegality

A situation where a law change after an agreement is made renders the performance of the contract illegal.

Impossibility

A concept in contract law where unanticipated events make the fulfillment of a contract's terms unfeasible or unable to be completed.

Q2: (Ignore income taxes in this problem. )DE

Q16: (Ignore income taxes in this problem. )The

Q40: Quinnett Corporation has two divisions: the Export

Q58: Manufacturing overhead is overapplied if actual manufacturing

Q71: Phong Corporation has two divisions: Consumer Division

Q72: Buth Inc.uses a job-order costing system in

Q108: During its first year of operations, Carlos

Q139: Hadley Inc. , makes a line of

Q145: (Ignore income taxes in this problem. )Allen

Q213: Roskos Corporation has two divisions: Town Division