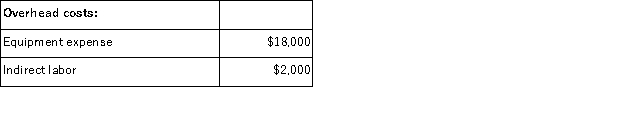

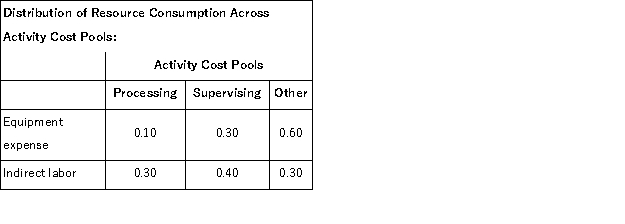

Kenrick Corporation uses activity-based costing to compute product margins.In the first stage, the activity-based costing system allocates two overhead accounts-equipment expense and indirect labor-to three activity cost pools-Processing, Supervising, and Other-based on resource consumption.Data to perform these allocations appear below:

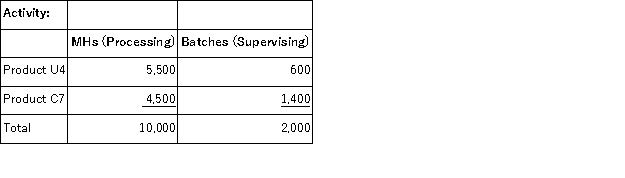

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

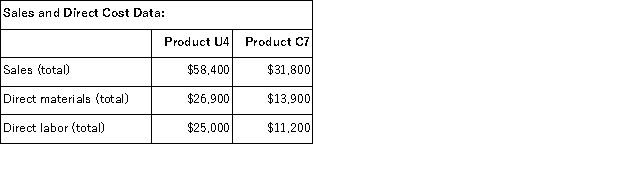

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.  What is the overhead cost assigned to Product U4 under activity-based costing?

What is the overhead cost assigned to Product U4 under activity-based costing?

Definitions:

Communication

The process of transferring information, thoughts, and feelings through verbal or non-verbal means.

Morale

The confidence, enthusiasm, and discipline of a person or group at a particular time.

Industrial/Organizational Psychologist

A professional who applies psychological theories, principles, and research methods to understand workplace behavior, enhance employee well-being, and improve organizational performance.

Medical Doctor

A trained professional who practices medicine, which involves promoting, maintaining, or restoring health through the study, diagnosis, prognosis, and treatment of disease, injury, and other physical and mental impairments.

Q31: Two alternatives, code-named X and Y, are

Q57: Malan Corporation has provided the following data

Q75: Which of the following levels of costs

Q96: (Ignore income taxes in this problem. )Vernon

Q108: The costs of activities that are classified

Q110: Depreciation expense on existing factory equipment is

Q137: Romasanta Corporation manufactures a single product.The following

Q151: Crooks Corporation processes sugar beets in batches

Q154: Peterson Corporation produces a single product.Data from

Q183: Farron Corporation, which has only one product,